Is It Ok To Invest In Exchange Traded Funds In 2024?

With the current rate of inflation globally and an impending recession in the next decade, having just one source of income isn’t enough. Therefore, investments have become a risky but profitable way to generate wealth. It would help if you learned more about Exchange Traded Funds (ETF).

If you are new to the world of investments, investing in the wrong place can lead to disaster. However, it’s ok to start investing when you are in debt. Therefore, before you invest, you must carefully research the market and learn about all the best investment choices you have.

I recommend investing in exchange-traded funds to make more money from your investments. Therefore, please read this post to learn more about ETFs and why they are a good investment.

What Are Exchange Traded Funds (ETF)?

Exchange Traded Funds are a collection of securities and stocks. They are a pool of investment securities bought and sold on the market.

Therefore, they are a form of investment security that holds multiple assets rather than only one like other investment types. Moreover, you can trade them like any form of stocks or bonds.

Since Exchange Traded Funds hold multiple securities, the amount you invest spreads across all the assets. Therefore, you purchase, you purchase one stock, then stock money spreads across various assets.

Moreover, if the valuation of one of these assets increases, so does your stock value! Therefore, if the valuation of all these securities increases – guess who gets lucky!

However, the opposite is true. If the valuation of one of these securities in the ETF – – or all of them decreases, guess who becomes unlucky!

One crucial aspect of ETFs is their valuation. They always base their valuation on market indexes. Therefore, depending on the index’s rise and fall, the ETF’s value will also rise and fall.

In the USA, exchange traded funds are considered open-ended. Therefore, they are subjected to the regulations of the Investment Company Act of 1940. As such, these funds don’t have any limit on the number of investors that can invest in them.

For example, the Vanguard Consumer Staples (VDC) ETF holds shares of over 100+ FMCG companies like Costco, Proctor & Gamble (P&G), PepsiCo, Coca-Cola, Walmart and more. Moreover, it keeps track of the MSCI US Investable Market Consumer Staples 25/50 Index. As such, most FMCG companies fall under this Index.

Therefore, if you invest $1 in VDC ETF, you own $1 shares of all the 100+ companies!

Exchange Traded Funds vs Mutual Funds

Since exchange traded funds are a pool of securities, you might wonder how different they are from mutual funds.

ETFs and MFs differ from each other like how ETFs are different from Private Real Estate Debt Funds. Therefore, their primary differences are:

| Difference | Exchange Traded Funds | Mutual Funds |

| Liquidity | ETFs trade on highly liquefiable stocks since you can trade them daily. | MF trade occurs at the end of the day. Therefore, their liquidity depends on their NAV price. |

| Expense Ratios | The expense ratio is lower (around 0.5%). | The expense ratio is higher (around 2.5%) |

| Risk | The risk is low since they duplicate stock indexes. | The risk is high since they don’t duplicate stock indexes. |

| Taxation | Profits for holding ETFs for over three years are taxable long-term capital gains. | Profits for holding ETFs are not taxable. |

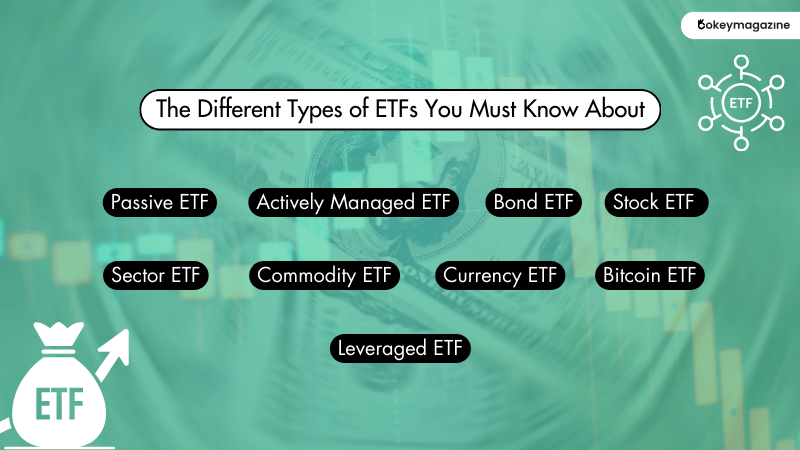

The Different Types of ETFs You Must Know About

Before investing in Exchange Traded Funds, you must know how many ETFs you can invest in. Moreover, this will help you realize whether it’s ok to choose growth stocks over income stocks.

Currently, there are ten types of Exchange Traded Funds, which are:

1. Passive ETF

Passive ETFs always base their securities on bigger indexes. Therefore, they target diversified indexes like the S&P 500 or bigger sectors and trends.

2. Actively Managed ETF

Unlike Passive ETFs, these do not base their securities on more extensive indexes. Instead, a portfolio manager manages them and makes all decisions.

Therefore, investors will reap the dividends. However, these ETFs are the most expensive.

3. Bond ETF

As the name suggests, these ETFs depend on the performance of the bonds under them. These bonds include government, local, state, and corporate bonds. Therefore, they provide regular income to investors, like share dividends.

Moreover, Bond ETFs are unique since they don’t have a set maturity date. This is the opposite of their underlying security.

4. Stock ETF

A Stock ETF houses a collection of stocks that reflect the growth of a specific industry or sector. For example, if you invest in an automobile stock ETF, its valuation will depend on the performance of the entire automobile industry.

However, if you invest in this ETF, you don’t get to own the stocks. You only get to reap their benefits by investing in them. Such ETFs have lower prices than other ETFs and mutual funds.

Therefore, the purpose of Stock exchange traded funds is to diversify the exposure a specific industry gets in the market. Moreover, these ETFs focus more on sectors that are currently booming.

5. Sector ETF

Sector ETFs are like stock ETFs. However, unlike stock ETFs that base their values on the industry’s performance, they focus on specific companies from a single sector.

6. Commodity ETF

Commodity ETFs base their valuation on specific commodities like gold or crude oil. Therefore, they are a good choice amongst investors who wish to diversify their portfolios and successfully hedge any market downturns.

However, remember that investing in commodity ETFs is cheaper than investing in the commodity itself!

7. Currency ETF

As the name suggests, currency exchange traded funds value themselves on the performance of currency pairs. Moreover, these currency pairs are always your domestic and a foreign currency.

Currency ETFs are popular since investors can speculate on a country’s economic development. Moreover, you can use them to diversify your portfolio. Furthermore, you can use these ETFs to hedge against volatile forex markets!

8. Bitcoin ETF

As the term suggests, these exchange-traded funds are the newest in the market, and their valuation is based on Bitcoin cryptocurrency. This ETF was introduced in the market recently by SEC in 2024.

Here, you will get exposure to Bitcoin’s price fluctuations in their traditional brokerage accounts by purchasing Bitcoins as the underlying security. This allows you to buy shares in the fund.

9. Leveraged ETF

Leveraged exchange traded funds are the most profitable ETFs since they can provide profits in multiples of 2x or 3x on the return of underlying security!

For example, if you see a 1% rise in the S&P 500 index, a leveraged S&P 500 ETF will return 2% of the value.

However, the opposite is also true, which can lead to twice the losses, simultaneously making it risky and profitable.

How To Start Investing in ETFs?

If you wish to invest in exchange traded funds, you must do so through online ETF brokers. In addition, you can do so through your regular broker-dealers.

However, you will find many pre-screened brokers operating in this industry. Moreover, you can also purchase ETFs with your retirement accounts. Furthermore, you can replace all these brokers with digital brokers like Wealthfront and Betterment.

However, before trading exchange traded funds, you must create and fund a brokerage account. Opening this account will allow you to search for exchange traded funds manually. Therefore, this allows you to invest some time in researching these funds and make the best investment decisions!

The Most Popular ETFs To Invest On

Now that you know what the different types of exchange traded funds are and how to trade ETFs, you might wonder: Which exchange trade funds must I invest in?

As of publishing this post, the best ETFs to invest in are:

- SDPR S&P 500 (SPY): This is the oldest and one of the most traded ETFs tracking the S&P 500 Index.

- iShares Russell 2000 (IWM): This ETF tracks the Russell 2000 Index for small capital funds.

- Invesco QQQ (QQQ): The QQQ exchange traded fund is about technology stocks tracking the Nasdaq 100 Index.

- SPDR Dow Jones Industrial Average (DIA): DIA tracks the Dow Jones Industrial Average, which holds 30 stocks.

Final Verdict: Is It Ok to Invest in Exchange Traded Funds?

Most investors will say that it’s Ok to invest in Exchange Traded Funds. Therefore, now that you know what ETFs are, it’s time to do more research and invest in ETFs.

One of the best aspects of ETFs is that they are inexpensive compared to other investment options. Moreover, they are relatively risk-free and help you diversify your investment portfolio!

Thanks for reading this post! Moreover, if you have any questions regarding investing in exchange traded funds, please comment below!

Read Also:

Post Your Comment