Which Best Describes The Difference Between Stocks And Bonds?

The inverter’s quest of finding the best assets to diversify their portfolio reaches an end at a diversion of Stocks and Bonds. So, which best describes the difference between stocks and bonds? Read on to know what each asset is and how they are similar or different.

Stocks allow the investors to gain partial ownership of the company shares. At the same time, bonds are the debt certificates issued by the government’s company in the bond market.

Stocks and bonds are the two traditional assets that have been in the market for centuries. Stocks and bonds act as a tool in the financial markets and help investors profit in short or long term investment.

Businesses use these as a tool to increase financial flow in the business. While stocks and bonds are meant to offer high profits to investors, they can be highly volatile, and if not taken seriously, they can accrue a hefty loss.

The only way to gain profit in the stocks and bonds is by understanding them to the core of their existence. This article will go through the information which best describes the difference between stocks and bonds.

Also Read: How To Become A Digital Media Manager

What Is A Bond?

One of the important features of the bind is the maturity value. When the bond matures, the entity repays the loan principal to the investors. This is the reason why bonds are called fixed-income investments and are less risky compared to stocks. A bond’s interest depends on its types.

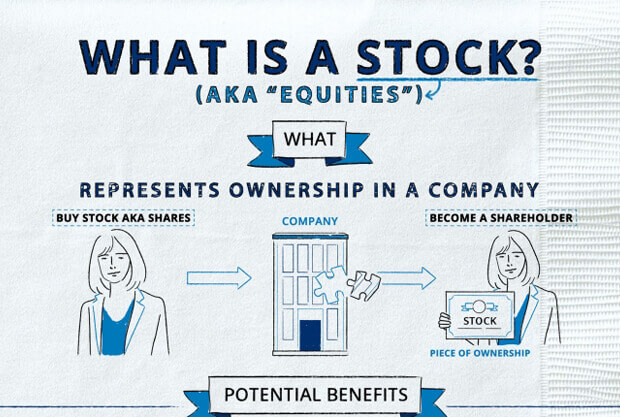

What Is A Stock?

Depending on how the market is performing, investors can choose a company’s stocks or shares. With the stocks, the user gains partial ownership of the company and is liable to get the dividend on the profits.

As an investor, you can gain profit when there is capital appreciation or the company gains massive revenue. The profitability ratio totally depends on the market performance of the company.

Also Read: How To Become A Social Media Expert

Stocks Vs. Bonds: Which Best Describes The Difference Between Stocks And Bonds

Both Stocks and Bonds carry a high amount of risks. Knowing the differences, similarities, and risks associated with each asset will make you a better investor.

Which Best Describes The Difference Between Stocks And Bonds?

| Parameters | Stocks | Bonds |

| Category | Equity | Debts |

| Issued By | Companies | Companies/Government |

| Types | Four | Twelve |

| Purposes | Offering Ownership | Loans to the company |

| Profit-Loss Ratio | Profit depends on the business’ performance | Bonds pay a fixed rate of interest |

| Rewards | Depending on market performance | Periodic fixed interest payment |

| Benefits | Investors own a portion of the company | Investors become lenders |

| Risks Level | High risk | Low risk |

| Offered As | Initial Public offering | Treasury bonds |

| Owners Are Called | Shareholder | Bondholder |

| Involved Parties | Brokers | Speculators |

| Maturity Period | At Investor’s will | Pre-Set Maturity time |

| Growth | 10% | 6% |

Frequently Asked Questions [FAQs]

Even after reading all the information about stocks and bonds, some questions go unanswered. We have picked these questions and have answered them below.

1. Which Type Of Portfolio Might A Young Investor Who Is Not Afraid Of Risk Choose?

Ans. A young investor has a risk tolerance and will find his calling from aggressive investing strategies. With that being in mind, stocks might be a more aggressive option to invest in. However, if you are jumping into the stock market, ensure that you have all the needed knowledge to execute your investment plan.

2. Are Bonds Better Than Stocks?

Ans. Well, that totally depends on what you are looking for in an instrument to invest your money on. Depending on your requirement, any one of the two can get the job done. In addition to that, you must take the associated risk into consideration.

Bonds are much safer than stocks and offer a fixed rate of interest to investors. At the same time, Stocks are riskier but offer high profits.

3. Is It Worth Buying Bonds In The Current Pandemic?

Ans. Having Bonds in your investment portfolio gives you an edge over the stocks, as they promise you a fixed rate of interest even in a crisis. Hence, if you can get a hold of good bonds, it will certainly be a fool’s choice to let it go.

4. Is It Worth Buying Stocks In The Current Pandemic?

Ans. If you are new to this whole stock market industry, it is better that you stay away from the stock market for a while. Due to the pandemic, the market is more volatile than it has ever had been. Hence, if you are not confident with your speculating skills and perfectly deduce how the market will flow, you are bound to accrue losses.

However, if you have been in the industry and know your thing, perhaps this is the best time to invest in the stocks when companies are selling them at the price of water.

Which Is Right For You?

Many people invest in both stocks and bonds to diversify their portfolio and their investment risks. The following factors decide the ans. of your question ‘ which best describes the difference between stocks and bonds?’ Which asset perfectly goes with your investment plans.

- Time Horizon.

- Risk Tolerance.

- Investment objectives.

If, after seeing the stock market falling and putting you in panic, it is better to choose Bonds over the stock market.

Read Also:

Post Your Comment