Is It OK to Invest in Low Duration Funds In 2024?

A solid investment portfolio has become necessary for everyone in this age. Having more than one revenue stream has become inadequate for most. Therefore, many people ask this question before they start investing: is it ok to invest in low duration funds in 2024?

Low duration funds have become popular over time since the minimum investment amount is lower than most other options. Moreover, since these investments mature quickly, they give a higher interest rate.

However, it’s best to learn more about low duration funds before you decide on them. Therefore, read this post to learn more about the best low duration funds to invest in 2024!

What Are Low Duration Funds?

As the name suggests, low duration funds have a short investment period. Unlike other types of long-term investments, these short-term investments have a short maturity period (hence the name).

These funds focus primarily on debt and money market securities. Therefore, you can liquify your investments quickly and easily since they have a lower maturity period. Moreover, their maturity period lies between six months to a year.

In addition, their interest rates fluctuate less, which makes them safe from interest spikes and drops. Therefore, if you are looking for investment options with a lower-risk profile, these funds are your best bet!

Why Must You Invest in Low Duration Funds?

There are many reasons why investing in low-duration funds is profitable. The primary reasons that separate them from exchange traded funds are:

1. Lower Interest Risk

One of the primary reasons why low duration funds are popular is because of their stable interest rates.

Most people consider investments risky and think twice about investing because of their fluctuating interest rates. This fluctuation increases or decreases your investment returns, leading to improper financial planning. Moreover, if it decreases, you will suffer losses!

Therefore, since short duration funds have shorter maturity periods, they are less susceptible to interest rate fluctuations. Therefore, the chances of you suffering losses are almost negligible!

2. Higher Liquidity

Since low duration funds have shorter maturity periods, you can liquify them easily and quickly.

Therefore, if you need money due to financial emergencies, you can easily break your investments instead of taking loans! This is why these investments serve as great cash flow opportunities!

3. Consistent Returns

One of the best reasons to invest in low duration funds is to get consistent returns.

As you already know, these funds are less susceptible to interest rate fluctuations. Moreover, since you can liquify them quickly, the returns you get from them are lower than other long-term funds.

However, this doesn’t make them unworthy investments. Though the returns lie in the middle of the scale, their consistency and assurance make them worthy investments in 2024.

4. Flexibility

Investors always want flexibility. As an investor, you would like to accrue surplus funds to finance your more demanding investments.

However, you must ensure this surplus funding comes from another reliable investment. This is where low duration funds become useful for gathering surplus funds over a short period. Therefore, they become attractive investment options.

5. Easier Portfolio Diversification

Finally, short-term funds are great investment options since they quickly help you diversify your investment portfolio.

Portfolio diversification is necessary to expose yourself to multiple investments. It’s important because relying on returns from one investment isn’t a good idea. Therefore, spreading your money across numerous investments is the best way to invest.

Since short-term funds have low maturity periods, investment values, and less volatile interest rates, they are one of the best ways to diversify your portfolio in 2024!

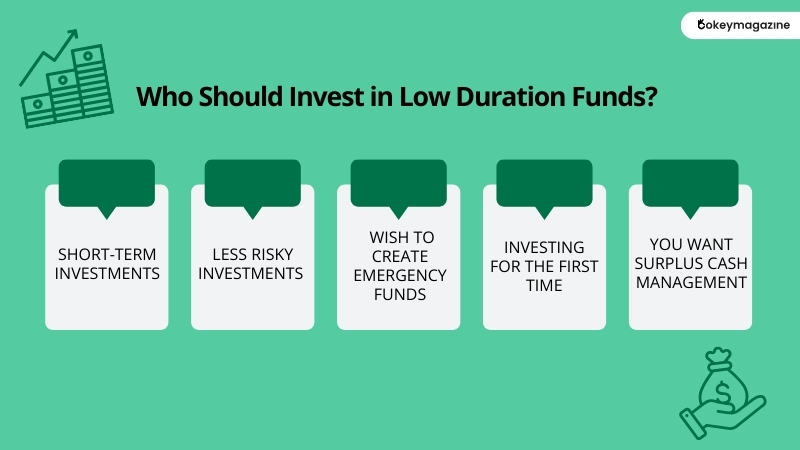

Who Should Invest in Low Duration Funds?

Low duration funds are suitable if you want:

1. Short-Term Investments

Short-duration funds are a good choice if you prefer keeping short-term financial goals and are not investing in long-term returns. Moreover, consider investing in such options if you wish to park funds for a short period.

2. Less Risky Investments

If you wish to invest in low-risk options, invest in short-term funds since they have fewer associated risks.

3. Wish to Create Emergency Funds

If you want to make investments that you can liquify quickly to generate emergency funds, these investments will be a good option.

4. Investing For the First Time

If you are new to investing, the three reasons above must be convincing enough to consider investing in low duration funds – unlike private real estate debt funds!

5. You Want Surplus Cash Management

If you have surplus cash that you wish to invest in low-risk and highly liquefiable investments, consider investing in these funds.

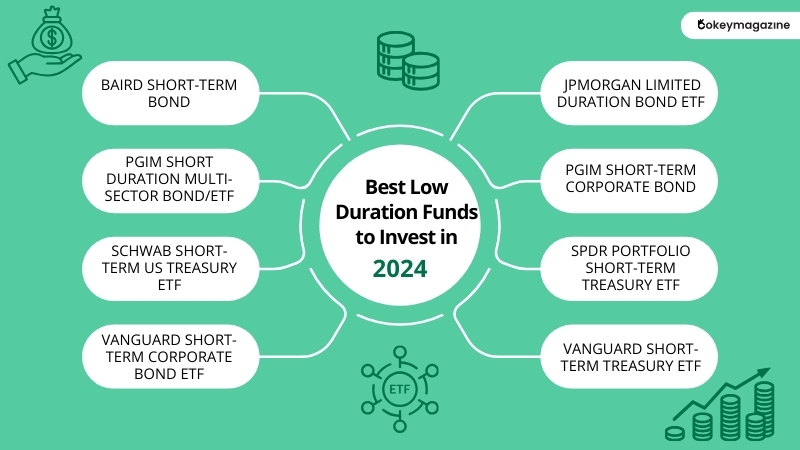

Best Low Duration Funds to Invest in 2024!

Now that you are considering investing in low duration funds, we have created this list of the best short-term funds for you.

1. Baird Short-Term Bond (BSBIX)

Duration: 1.84 years

Expense Ratio: 0.55%

This low duration fund is an excellent choice for conservative investors since it takes on more credit risk than the Bloomberg US Credit 1-3 Years Index. Moreover, this fund’s managing team makes this fund more valuable by suitably selecting the underlying sector-dependent securities.

2. JPMorgan Limited Duration Bond ETF (JPLD)

Duration: N/A

Expense Ratio: 0.24%

Previously a mutual fund (till June 2023), this ETF is a collection of low duration mortgages and asset securities. However, JP Morgan has made this ETF less volatile than other ETFs since they have strict procedures for selecting securities with stable durations.

3. PGIM Short Duration Multi-Sector Bond/ETF (SDMZX PSDM)

Duration: 1.94 years

Expense Ratio: 0.4%

If you prefer taking more risks to gain profits, consider investing in this low duration fund. This fund’s managers try to perform better than its benchmark, the Bloomberg US Credit 1-3 Years Index.

Therefore, they try to keep a difference of 150 points annually to give you higher yields on emerging market debts.

4. PGIM Short-Term Corporate Bond (PSTQX)

Duration: 2.66 years

Expense Ratio: 0.38%

The second PGIM-managed fund to make it to this list, this investment has the most extended duration. Like the option above, it tries to perform better than its index – the Bloomberg US Credit 1-5 Years Index – annually by 0.6%!

However, this fund’s managers do so by focusing on corporate bonds, rotating securities and sectors. Therefore, this fund takes on more risk than other funds.

5. Schwab Short-Term US Treasury ETF (SCHO)

Duration: 1.89 years

Expense Ratio: 0.03%

This is a passive bond ETF, which tracks the Bloomberg US Treasury 1-3 Year Index. Since this bond has higher liquidity than its peers due to its association with the US Treasury Bond market, it’s one of the best low duration funds on this list.

In addition, you suffer from zero credit risk since this fund focuses on lesser yields with lesser volatility.

6. SPDR Portfolio Short-Term Treasury ETF (SPTS)

Duration: 1.85 years

Expense Ratio: 0.03%

Like the option above, this low duration fund is another great passive ETF with low costs. Moreover, like Schwab’s option above, this fund primarily holds US Treasuries. Therefore, you suffer from zero credit risk due to its focus on lower-yield funds.

7. Vanguard Short-Term Corporate Bond ETF (VSTBX VCSH)

Duration: 2.61 years

Expense Ratio: 0.04% (ETF), 0.05% (Mutual Fund)

This low duration fund is available as both a mutual fund and an ETF, tracking the Bloomberg US 1–5 Year Corporate Bond Index. Therefore, it focuses on US corporate bonds, which have higher credit risks than other options on this list.

However, this fund gives you accurate accessibility to cheaper investment options. Moreover, Vanguard has always been a long-term high performer in the market, making this bond a good investment choice!

8. Vanguard Short-Term Treasury ETF (VSBSX VGSH)

Duration: 1.88 years

Expense Ratio: 0.04% (ETF), 0.07% (Mutual Fund)

Finally, we have another Vanguard low duration fund, the Short-Term Treasury ETF. Like the previous Vanguard fund, this option is also available as an ETF and a mutual fund.

This ETF keeps track of the Bloomberg US Treasury 1–3 Year Index, which consists solely of US Treasuries, which take three years to mature. Therefore, you suffer minimal credit risk since it focuses on high-quality securities!

So, Is It OK To Invest in Low Duration Funds?

The answer to your question – is it ok to invest in low duration funds in 2024 – is yes.

These short-term investments will be a good choice if you want funds that mature quickly and are less risky and highly liquifiable. They can give you quick financial gains, which are consistent, unlike other investments!

Thanks for reading this post! Please comment below If you need more guidance before investing in low duration funds!!

Read Also:

Post Your Comment